QR codes have transformed how we pay by making transactions faster and more secure. Here’s the gist:

- How It Works: Customers scan a QR code with their smartphone to pay – no cash or cards needed.

- Static vs. Dynamic QR Codes: Static codes are fixed, while dynamic codes allow updates and provide tracking features.

- Popularity: By 2026, over 102.6 million U.S. users are projected to use QR code payments.

- Benefits for Businesses: Faster transactions, reduced physical contact, and customer trust.

- Industries Leading the Way: Retail, restaurants, public transit, and events.

- Setup Steps: Choose a payment provider, create QR codes, customize them, and test thoroughly.

- Best Practices: Place codes visibly, ensure secure usage, and use analytics to track performance.

QR codes aren’t just a trend – they’re reshaping how businesses and consumers interact. With the right setup, they simplify payments and improve customer experience.

QR Code Payments: A New Era of Convenience in Digital Transactions

How QR codes work for contactless payments

QR code payments connect the physical and digital worlds, making transactions faster and more secure. By turning a smartphone into a payment tool, this method simplifies the process for both customers and businesses.

The mechanics of QR code payments

Here’s how it works: a QR code is generated, displayed, scanned, decoded, authorized, processed, and finalized with confirmation. At checkout, the vendor presents a QR code. The customer scans it using their smartphone camera, which opens a payment page or notification showing the transaction details. After reviewing the amount, the customer enters any required information – like a PIN – and authorizes the payment. The process wraps up when the vendor sends a digital receipt or confirmation to the customer’s device.

Major retailers have adopted this system, showcasing its speed and ease of use.

Static vs. dynamic QR codes for payments

When it comes to QR code payments, you can choose between static and dynamic codes. Static QR codes store fixed information, meaning customers usually need to manually input the payment amount [4, 18]. On the other hand, dynamic QR codes pull information from an online source, allowing details like the total amount to be pre-filled. This reduces errors and speeds up the process [4, 18].

Here’s a quick comparison of the two:

| Feature | Static QR Codes | Dynamic QR Codes |

|---|---|---|

| Editability | Cannot be changed after creation | Can be updated even after printing |

| Tracking | No tracking capabilities | Includes tracking & analytics |

| Retargeting | Not usable for retargeting | Enables online retargeting |

| URL | Long and complex | Short and clean |

| Scan Speed | Slower to scan | Faster scanning |

| Campaign Delivery | Cannot support multiple campaigns | Can schedule and deliver campaigns |

Dynamic QR codes are especially useful when details like pricing or promotions change frequently. They also offer advanced tracking and analytics, giving businesses insights into customer behavior. If you’re interested, you can create a dynamic QR code to explore these benefits.

Common payment flows using QR codes

QR codes are versatile and can be adapted for various industries. Retail stores, public transit systems, ride-sharing services, parking facilities, and event organizers use them to simplify payments and manage access. QR codes can appear on digital screens for real-time updates or on printed materials like menus and flyers, offering flexible display options.

Payment flows can also be customized. For example, restaurant customers might scan a QR code at their table to split the bill or leave a tip, while retail shoppers can use QR codes for a quick checkout. When creating a QR code for payments, think about how your customers interact with your space and where they’re most likely to complete transactions.

Up next, we’ll guide you through setting up these payment systems step by step.

Step-by-step guide to setting up QR code payments

Setting up QR code payments involves three main steps: choosing a payment provider, creating and customizing your QR codes, and thoroughly testing them before launching.

Selecting a payment provider

The payment provider you choose will serve as the backbone of your QR code payment system. Prioritize security when evaluating options – make sure the provider adheres to global security standards and complies with local regulations. Look for features like end-to-end encryption and two-factor authentication to protect transactions.

Beyond security, consider how well the provider integrates with your existing systems, such as your POS, accounting software, or CRM. If your business operates internationally, ensure the provider supports multiple currencies and is available in all your markets. It’s also essential to review fee structures, including monthly charges, transaction fees, and any hidden costs. Depending on your needs, you may also want advanced features like analytics, inventory management, or loyalty program support.

Finally, test different payment apps to assess their usability and reliability. Once you’ve selected a secure and compatible provider, you can move on to generating and personalizing your QR codes.

Creating and customizing QR codes

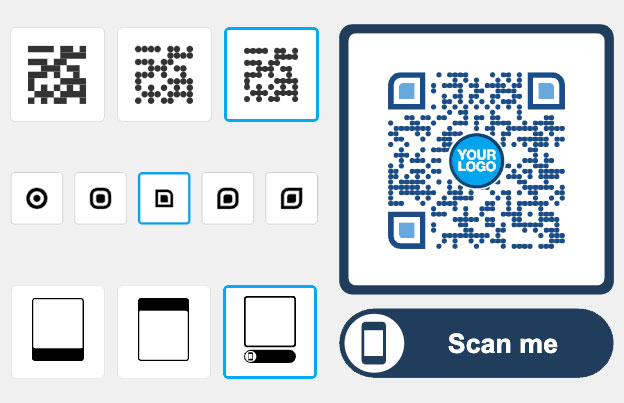

After choosing your payment provider, the next step is creating your QR codes. While the exact process may differ by platform, it typically starts by generating a payment link through your provider’s dashboard. Once you have the link, use a QR code generator to convert it into a scannable code. For instance, tools like Pageloot’s free QR generator make this simple – just paste your payment link, and the tool will instantly create your QR code.

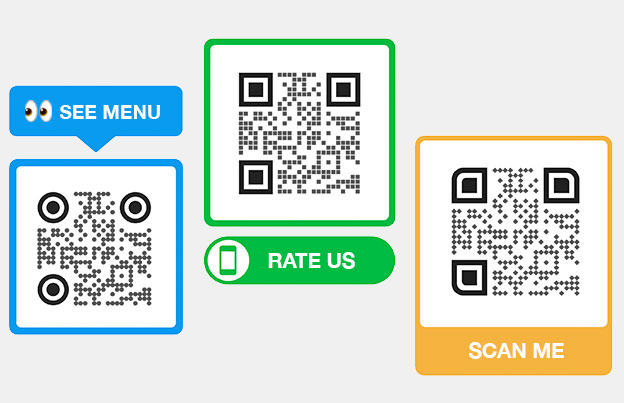

Customizing your QR codes is a great way to align them with your brand. Add your business logo to build trust and recognition, tweak the colors to match your branding, and use a frame for a polished appearance . Dynamic QR codes are especially useful since they allow you to update payment details without reprinting. Include a clear call to action, such as "Scan to Pay" or "Quick Checkout", to make the purpose of the code obvious to customers. Once your designs are ready, test the codes thoroughly to ensure they work flawlessly.

Testing and deploying QR codes

Before rolling out your QR codes, test them rigorously on different smartphones and scanning apps to confirm they work as intended. Experiment with various scanning angles and distances to ensure reliability. Placement is equally important – position your QR codes where customers naturally expect to make payments. For example, restaurants might feature them on menus or table displays, while retail stores could use them on product labels or at checkout counters.

Pay attention to details like size and print quality to ensure the codes are easy to scan. Environmental factors, such as proper lighting and minimal glare, can also make a big difference in usability.

Lastly, train your staff on how the QR code payment system works. This way, they can assist customers confidently and help ensure a smooth transition to the new payment method.

Best practices for secure and effective QR code payments

Once you’ve set up your QR code payment system, fine-tuning how you display, secure, and track its performance can make a big difference. Below, we’ll explore strategies for optimizing your QR code display, ensuring security, and leveraging analytics for better results.

Displaying QR codes effectively

To make QR codes easy for customers to scan, place them in accessible and visible locations. Ensure the code is at least 1×1 inch (2.5×2.5 cm) to work reliably with various smartphone models.

Placement matters, too. Use table tents, stand-up cards, or eye-level displays to make the codes noticeable. For instance, in retail stores, QR codes work well at checkout counters or in window displays where they can grab attention.

Scannability depends on good design. Ensure there’s strong contrast between the QR code and its background. Avoid placing the code over busy patterns, images, or text. A clean, light-colored margin around the code helps scanning apps detect its boundaries.

"When done well, QR codes can streamline the shopping experience, providing immediate access to product specs, reviews or promotions."

– Bellamy Grindl, Principal and Founder, Retailytics

Clear instructions encourage customers to use QR codes. Simple messages like “Scan to Pay” or “Touch-Free Payment Available” on signage or through staff guidance can make the process more user-friendly. Once your QR codes are easy to spot and scan, the next step is securing them.

Enhancing QR code security

Security is critical when it comes to QR code payments. Use encrypted systems to protect customer data during transactions. Place QR codes in secure, visible areas where staff can monitor them to prevent tampering. Regularly check for malicious overlays or replacements, especially in high-traffic locations. Tamper-evident materials or protective covers can provide an extra layer of security in these areas.

Adding two-factor authentication to verify transactions can further reduce the risk of unauthorized payments.

"Businesses want to use the power of mobile phones that practically all consumers have with them… QR codes became easy, convenient and known to everyone."

– Randy Pargman, Senior Director of Threat Detection, Proofpoint

Conduct regular security audits to uncover and fix vulnerabilities before they escalate. These audits should include checks for tampering, software updates, and compliance with industry standards. Educating customers about scanning only official payment codes also helps minimize risks.

Dynamic QR codes, which can be updated in real time, offer flexibility in addressing potential security issues.

Tracking performance with analytics

The effectiveness of QR codes improves significantly when paired with analytics. Real-time data can reveal scan rates, peak usage times, and geographic trends. Since 98% of QR codes are dynamic and trackable, businesses can gain valuable insights into customer behavior and system performance.

Key performance indicators, such as device types used for scanning, scan-to-payment conversion rates, and time-of-day activity, can highlight areas for improvement. Integrating QR code data with platforms like Google Analytics provides a more complete view of the customer journey.

Use these insights to refine your operations. For example, analyzing scan patterns can guide staffing during busy periods, while testing different QR code designs, sizes, and placements can reveal what resonates most with your audience. This adaptability helps you fine-tune promotions and respond quickly to shifting customer preferences.

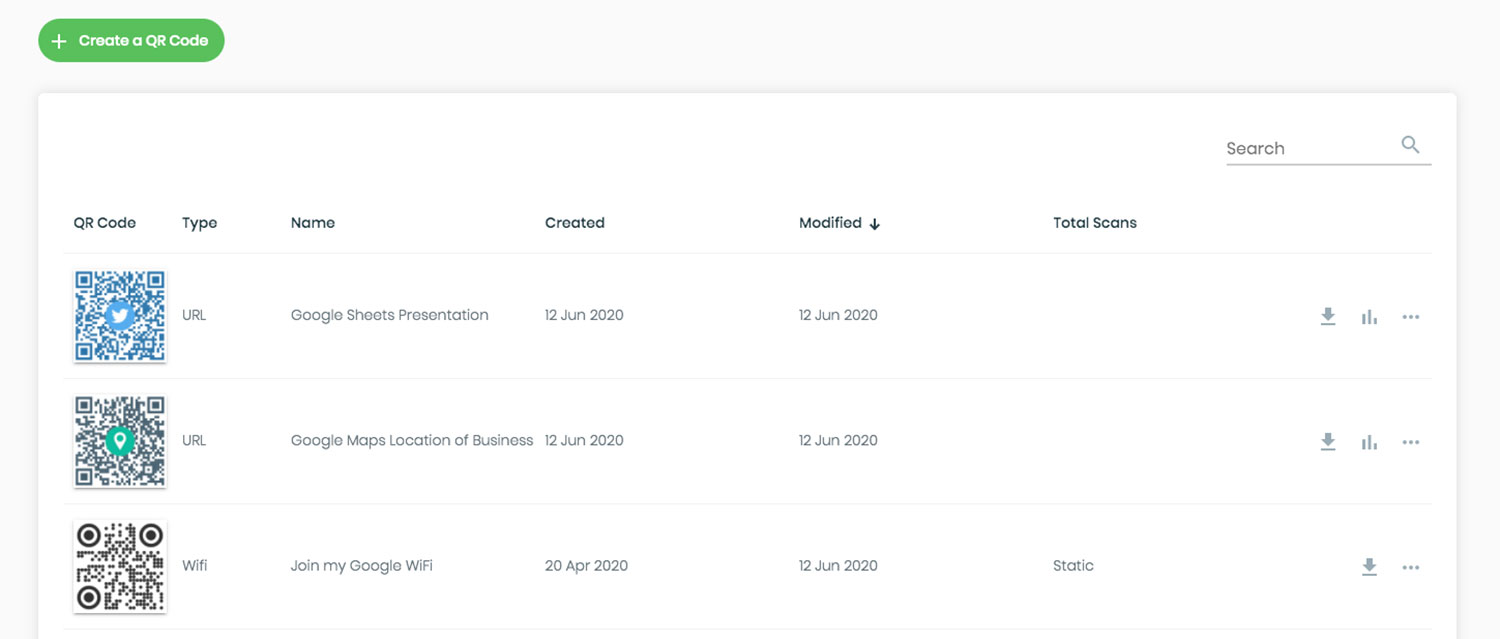

Pageloot’s analytics dashboard offers a detailed look at scan activity, demographics, and conversion rates. These insights not only improve security but also enhance the overall customer experience. Additionally, Pageloot’s free QR generator allows you to customize and manage your codes with ease.

sbb-itb-74874c9

Advanced customization and analytics with Pageloot

Basic QR code payment systems can handle the essentials, but if you’re aiming to gain deeper insights and outshine the competition, you’ll need something more robust. Pageloot’s platform steps in with advanced customization and analytics tools designed to elevate the contactless payment experience. These features integrate smoothly with your current payment system, offering both tailored options and actionable data.

Dynamic QR codes and editable features

Dynamic QR codes take convenience to the next level, and Pageloot makes them even more versatile. With the ability to modify payment details in real time, you can update links, offers, or payment processors without needing to reprint codes. This is a game-changer for businesses that frequently switch payment providers or run seasonal promotions. The same QR code on your business cards or flyers stays functional, even with updated information.

Pageloot offers a 14-day free trial, giving you access to premium features like advanced analytics and full customization. This trial period allows you to test different payment flows and adjust based on customer behavior. The platform supports over 25 QR code types, covering everything from in-store purchases to event ticketing and online transactions.

Branding and customization

A QR code isn’t just a functional tool – it can also be a branding opportunity. Generic designs might work, but branded QR codes help build trust and enhance your professional image. Pageloot’s customization tools let you fine-tune your QR codes to align with your brand identity while ensuring they remain easy to scan.

Once you’ve input your payment data, you can customize elements like body type, colors, edges, frames, and gradients. Want to add your logo? Use a high-quality image that stays sharp even at smaller sizes and contrasts well with the QR code background. Including a clear call-to-action, such as “Scan to Pay” or “Touch-Free Checkout,” ensures customers instantly understand what to do.

Real-time analytics and integrations

Customer interactions can provide a goldmine of data – if you know how to capture it. Pageloot’s analytics dashboard gives you a detailed look at scan patterns, customer behavior, and payment conversion rates. With real-time tracking, you can see when and where codes are scanned, as well as the devices used. This data can help you optimize operations and pinpoint high-performing locations.

One standout feature is the ability to update QR codes without reprinting, which makes A/B testing a breeze. Experiment with different payment flows or promotional offers using the same code, then use analytics to identify what works best. Plus, Pageloot integrates with marketing automation tools, turning payment data into opportunities for targeted campaigns. These insights ensure your payment system keeps pace with customer preferences, making it easier to refine your approach over time.

Common Use Cases and Trends for QR Code Payments

With projections estimating the QR code payment market will grow from $15.95 billion in 2025 to $73.44 billion by 2035, it’s clear that businesses are embracing contactless payment methods more than ever. Let’s dive into some key scenarios where QR code payments are making a big impact.

Contactless In-Store Payments

In physical stores, QR codes have become a go-to solution for streamlining checkout processes. Many retailers now use static QR codes at checkout counters. Customers simply scan these codes using their mobile payment apps, which automatically fill in the retailer’s payment details. All the customer has to do is enter the purchase amount. This setup not only speeds up transactions but also significantly reduces the need for expensive point-of-sale (POS) systems.

For retailers, this means faster checkout times and lower infrastructure costs. To make the system even more effective, businesses can use a QR code generator with customization options. This ensures the codes align with the brand’s visual identity while remaining easy to scan.

Event Check-Ins and Ticketing

QR codes are transforming the way events like concerts, conferences, and sporting events handle ticketing and check-ins. Event organizers can print QR codes directly on digital tickets, which are then used to verify purchases and grant entry. When attendees buy tickets online, they receive a QR code via email or text. At the venue, they simply show the code on their phone for quick access.

This approach not only speeds up entry but also reduces bottlenecks at the door. QR codes can also be used for payments at concession stands and merchandise booths, creating a seamless experience for attendees. Events, much like retail, are reaping the rewards of QR-driven efficiency.

Personalized Marketing Through QR Codes

QR codes are also helping businesses create more tailored marketing experiences. Research reveals that 95% of businesses find QR codes useful for collecting valuable first-party data, and 79% use dynamic QR codes to offer personalized, context-aware interactions. For instance, after a customer completes a purchase via a QR code, businesses can immediately follow up with personalized offers, loyalty program invitations, or feedback requests.

"The best QR experiences don’t just send people somewhere – they give them exactly what they need, when they need it."

– Uniqode

This personalization goes beyond the checkout process. Restaurants, for example, can use QR codes on menus to suggest dishes based on previous orders or dietary preferences. Similarly, retail stores can send targeted discounts or product recommendations shortly after a purchase. By integrating QR code payment data with tools like email marketing platforms, customer relationship management systems, and loyalty programs, businesses can gain a deeper understanding of customer behavior. This, in turn, supports more effective marketing campaigns and boosts customer retention.

Looking ahead, QR code payments are set to become even more sophisticated. Artificial intelligence is enabling real-time personalization, while blockchain technology is enhancing security. As Gartner predicts that 80% of commercial activity will be contactless by 2025, businesses that adopt and refine these QR code applications now will be better prepared for the future. A strong QR code system isn’t just about convenience – it’s about staying ahead in an increasingly contactless world.

Conclusion

QR codes have transformed the way contactless payments work, offering secure, adaptable, and affordable solutions. From retail shops to event organizers, these codes provide much more than just convenience – they bring efficiency and flexibility to the table.

They’re easy to set up, even without technical skills, and come with features like bank-level security, instant payment notifications, and the ability to work across multiple channels. Whether you’re printing them on business cards, posters, or displaying them on digital screens, QR codes eliminate the need for costly hardware. You’ll find them used everywhere – from in-store displays like menus to event tickets.

Another major advantage is real-time analytics, which not only enhance security but also provide valuable customer insights. This helps businesses refine their strategies and optimize QR code placement. Dynamic QR codes take it a step further by allowing updates without the hassle of reprinting, making them ideal for businesses that frequently change offers or run seasonal promotions.

With Pageloot’s user-friendly platform, businesses can design and manage QR codes that reflect their brand while gaining access to powerful analytics and real-time updates. The platform’s marketing automation features are a game-changer for small and medium businesses looking to thrive in today’s contactless economy. It’s never been easier to create QR codes and track their performance instantly.

FAQs

What is the difference between static and dynamic QR codes, and which one is better for my business?

Static QR codes are set in stone – once created, they can’t be changed. They work well for straightforward, unchanging purposes like linking to a restaurant menu or adding contact information to a business card. However, they come with limitations: no flexibility and no way to track performance.

Dynamic QR codes, however, are a game-changer. They’re editable and trackable, meaning you can update the content or URL without replacing the code itself. This makes them ideal for businesses that need real-time updates, access to analytics, or the ability to reuse codes for campaigns that evolve over time.

For businesses focused on staying flexible and gaining insights into performance, dynamic QR codes are the smarter option. They’re particularly useful for marketing efforts, improving customer engagement, and monitoring results over time.

How can businesses keep QR code payments secure and protect customer information?

To keep QR code payments secure and safeguard customer information, businesses should stick to using reputable QR code providers and steer clear of unverified or questionable codes. Built-in smartphone scanning apps or trusted QR code scanners are great tools for spotting and blocking harmful links, helping to cut down on fraud and data breaches.

Another smart move is using dynamic QR codes. These codes can be updated or disabled if they’re compromised, adding an extra layer of protection. On top of that, regularly educating both staff and customers about safe QR code usage can go a long way in reducing risks and ensuring a more secure contactless payment process.

How can businesses set up QR code payments and make the most of them?

To set up QR code payments, start by selecting a reliable payment provider that supports this method. Once you’ve made your choice, platforms like Pageloot can help you create and customize QR codes. With Pageloot, you can design codes to align with your brand’s look and even update them later without needing to reprint.

Place these QR codes in visible locations within your business, such as checkout counters or tables, and make sure customers have clear instructions on how to scan and pay. Regular testing is essential to confirm the system is secure and working smoothly. Additionally, consider tools that provide real-time analytics to monitor payment trends and customer activity, giving you insights to fine-tune your approach.

Using features like branded designs, dynamic updates, and detailed analytics, businesses can make payments easier for customers while streamlining their own operations and boosting engagement.