QR codes are reshaping how businesses handle payments, making transactions faster and more accessible. By 2022, the global QR code market reached $9.98 billion, with a projected annual growth rate of 16.9% through 2030. Businesses like CVS, Venmo, and Square are leveraging QR codes to simplify payments, reduce costs, and enhance customer experiences. Key benefits include:

- Cost Savings: No need for expensive hardware like traditional POS systems.

- Ease of Use: Payments can be completed in seconds with a smartphone scan.

- Security: Advanced encryption and fraud detection ensure safe transactions.

- Data Insights: Dynamic QR codes provide real-time analytics for smarter business decisions.

Companies like Pageloot offer tools to create customizable and dynamic QR codes, helping businesses streamline operations and cater to customer preferences. QR codes are also driving innovation globally, integrating with AI and blockchain for smarter, safer, and more personalized payment systems.

Whether you’re a small café or a large retailer, QR codes provide a simple way to modernize payments, improve customer satisfaction, and stay competitive in a rapidly evolving market.

How to Collect Payments With QR Codes

Case Studies: Successful Implementations

Several major payment platforms have seamlessly incorporated QR codes into their peer-to-peer payment systems, showcasing how effective this technology can be across various business models and user demographics.

Venmo and PayPal

Venmo has become a go-to name for peer-to-peer payments in the United States. According to recent data, 83% of Americans are familiar with Venmo, and 31% actively use it. The platform’s integration of QR codes has simplified transactions, allowing users to make quick, hassle-free payments. Shivam Singh, a content writer at Scanova, captures this efficiency:

"Venmo QR Codes make paying fast, easy, and frustration-free. No more typos or awkward ‘Who do I pay?’ moments – just scan and go."

Venmo’s QR codes are utilized in a variety of ways. Retailers and small businesses use them to speed up purchases, while restaurants and cafes display them on tables, menus, or receipts, enabling customers to pay without waiting. Freelancers like personal trainers, photographers, and tutors also benefit from this streamlined payment option. Venmo ensures these transactions are secure with robust encryption and fraud detection, all while remaining free of extra charges for individual users.

Similarly, Square has embraced QR codes to improve both in-person and online payment experiences.

Square

Square offers a range of QR code solutions tailored to meet diverse business needs. These solutions are provided at no extra cost, with businesses only paying standard processing fees when a sale is completed. Square’s QR codes work seamlessly with major credit and debit cards, Apple Pay, Google Pay, Square Pay, and Cash App Afterpay, offering customers a wide array of payment options.

Square has integrated QR codes into various touchpoints, including in-person point-of-sale systems, online self-service ordering for restaurants, and contactless checkouts for specific items.

Liz Fiedler from The Junction highlighted the operational benefits:

"Our labor cost percentage for an entire beer garden is 150% less than it was when I owned a 300 square foot shop, and that’s entirely because of QR code ordering."

Dean Settle from Metro Gallery Store shared:

"Using QR codes for our pop-up galleries lets us sell at any location, anytime. Buyers scan the code for a specific piece of art to see the price and purchase from their phones."

Similarly, Amy from Honey Art Cafe noted:

"We use QR codes so customers don’t need to line up and order at the counter. Employees can focus more on quick and accurate fulfillment, and creating the best guest experience."

Alipay and WeChat

In Asia, Alipay and WeChat Pay have transformed the payment landscape, driving a near-cashless society where 98% of urban residents now use digital wallets. WeChat Pay, embedded within the WeChat super app, has achieved widespread adoption, with 93% usage in Chinese cities and over 1 billion active monthly users . Meanwhile, Alipay, Alibaba‘s payment platform, holds over 50% of the market share and is particularly popular for online shopping. In contrast, WeChat Pay dominates in-person transactions.

During Chinese New Year in 2019, WeChat facilitated the exchange of 820 million virtual red envelopes (hongbao), showcasing its cultural relevance and convenience. Both platforms continue to expand their offerings, such as supporting international credit cards and introducing new features like Alipay’s "WeChat Friend Transfer", which uses QR codes for seamless payments.

These examples highlight how QR codes can thrive in different payment ecosystems. Their success lies not just in the technology itself but in how well they align with user habits, ensure security, and deliver clear benefits for both businesses and consumers. For businesses looking to adopt similar systems, tools like Pageloot’s dynamic QR code generator provide the flexibility and analytics needed to create effective payment solutions.

Benefits of QR Codes for Peer Payments

Platforms like Venmo and PayPal have shown how QR codes can simplify peer-to-peer transactions. But the advantages go far beyond just convenience, offering practical benefits for both businesses and customers.

Cost Savings

One of the standout perks of QR codes is how they eliminate the need for expensive hardware. Traditional payment systems often require costly point-of-sale (POS) setups, card readers, and ongoing maintenance. Experts highlight that QR code technology is a much more budget-friendly option, sparing businesses from these financial burdens. For small businesses or freelancers, this can make a world of difference. Imagine a small exporter using QR codes to allow international customers to pay instantly in their local currency. On top of saving money, QR codes also make the payment process much more straightforward.

Easy to Use

QR code payments are not just cost-effective – they’re incredibly simple. By reducing multiple steps into a quick scan, they make transactions faster and smoother. Payments can often be completed in just a few seconds, avoiding common hassles like entering long account details. Adoption of this technology is growing rapidly; by 2022, 24% of restaurants were using QR codes for menus, ordering, or payments. This ease of use makes QR codes accessible to everyone, regardless of tech know-how. Plus, the combination of convenience and strong security features ensures a hassle-free payment experience.

Security and Privacy

While early concerns about security existed, QR code payments now incorporate advanced protections like two-factor authentication, biometrics, and tokenization. Major platforms have adopted bank-level security measures. For example, Venmo uses encryption and secure servers to protect transactions, and PayPal employs similar encryption techniques to safeguard financial data. Additionally, Electronic Funds Transfer (EFT) payments add another layer of security with encryption and payer authorization. The global QR code payment market is expected to grow 59% between 2023 and 2028, reflecting growing trust in these systems. However, users should stay cautious by verifying QR code sources, sticking to trusted payment apps, and enabling security measures like two-factor authentication.

Data and Insights

QR codes provide businesses with insights that traditional payment methods simply can’t match. Using dynamic QR codes allows real-time tracking of scans and user interactions, offering valuable data for immediate adjustments. These codes can reveal when, where, and how customers engage, offering a clearer picture of customer behavior. For instance, a coffee shop might notice a spike in QR code scans on Monday mornings and use that insight to promote discounted coffee at the start of the week. With analytics influencing over half of companies’ marketing decisions, tracking scan data can also help businesses refine staffing, plan resources, and improve messaging strategies. When paired with tools like Google Analytics, QR code data becomes even more powerful, helping to identify drop-off points and optimize the payment process. For restaurants using QR codes for menus and payments, this data is crucial for tracking promotions and adjusting campaigns in real time based on customer behavior. These insights not only streamline transactions but also enable businesses to make smarter, data-driven decisions for ongoing improvement.

sbb-itb-74874c9

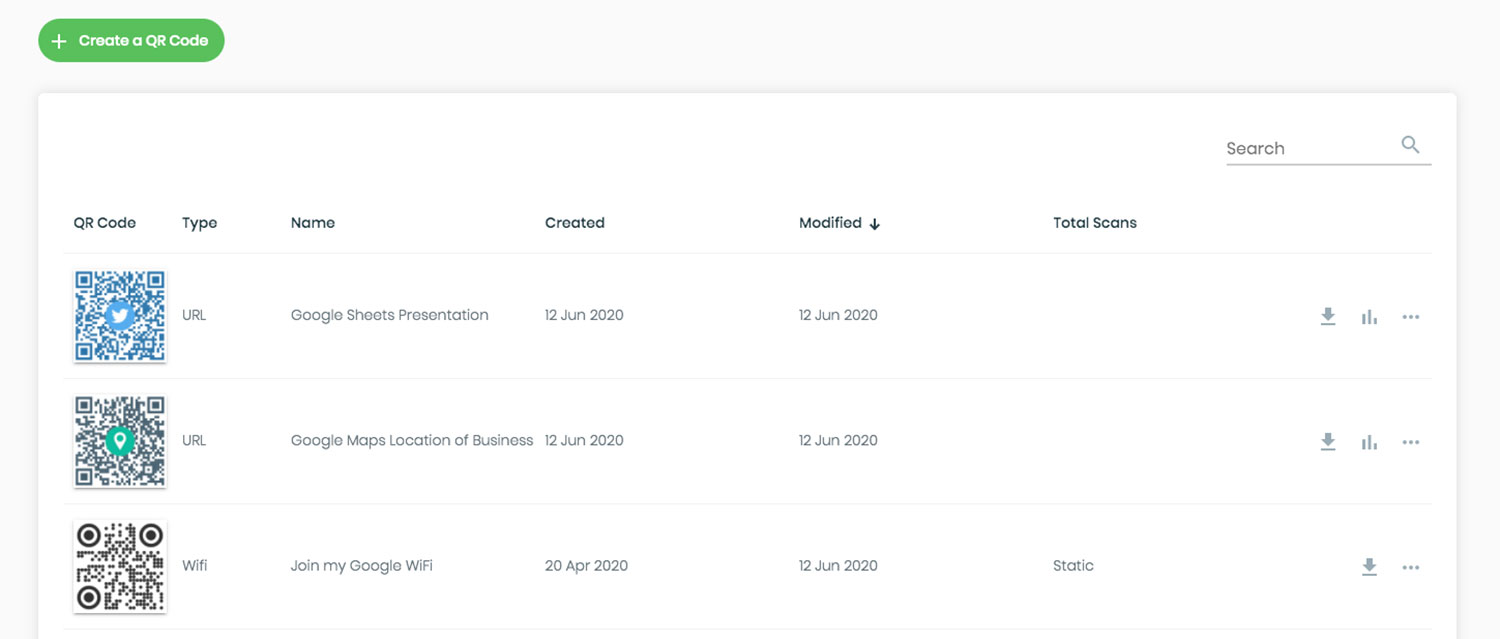

Implementing QR Codes with Pageloot

Pageloot makes adopting QR code payments straightforward and efficient. Whether you’re managing a small café or a large retail business, the platform offers tools to create, customize, and manage QR codes that simplify payment processes.

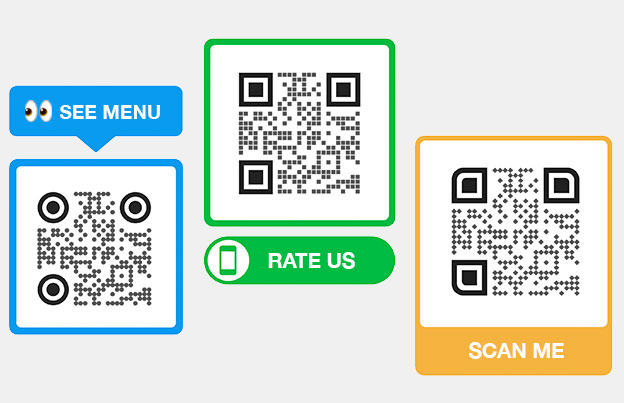

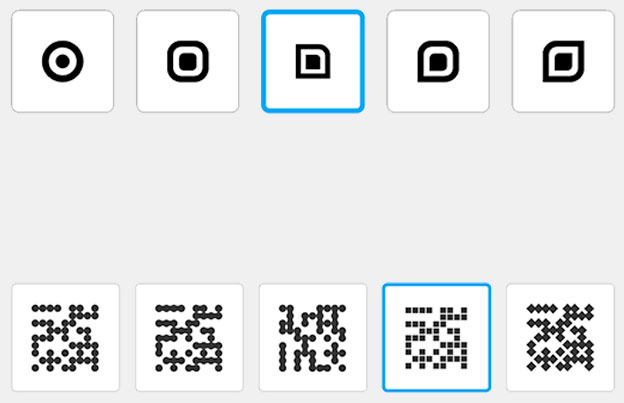

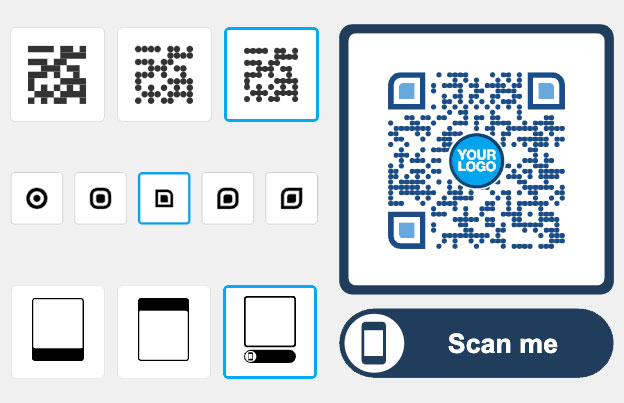

Customizable QR Codes

With Pageloot, you can design QR codes that reflect your brand’s identity by adding your logo, choosing colors, and using tailored templates. This not only enhances the professional look of your QR codes but also allows you to direct customers to specific payment pages or combine multiple functions into one code. For instance, a restaurant could create a menu QR code that also integrates payment options, streamlining the dining experience from ordering to checkout.

When customers see a QR code that aligns with your brand, it builds trust and encourages them to complete their transactions.

Real-Time Analytics

Tracking the performance of your QR codes is essential to refining your payment system. Pageloot’s analytics dashboard provides real-time data, showing when, where, and how customers interact with your codes. These insights include scan locations and engagement metrics, helping you optimize your payment strategies.

For example, if QR codes on your business cards are frequently scanned but payments are not completed, the data can highlight areas for improvement, such as simplifying the payment process or adding more options.

Dynamic QR Codes

One standout feature Pageloot offers is dynamic QR codes. Unlike static codes, dynamic QR codes can be updated without reprinting. This flexibility is particularly valuable for businesses that run promotions or need to adjust payment details. For instance, if you’ve printed QR codes on flyers for a campaign but later need to change the payment amount or add new options, dynamic codes allow you to make those updates instantly via the Pageloot dashboard.

This feature is ideal for businesses with seasonal offers or frequent updates, such as retail stores or restaurants. By using the same physical QR code year-round, you can update its destination to reflect current promotions, payment methods, or business details, saving both time and money.

How to Get Started

Creating a QR code with Pageloot is quick and easy. Use the free QR code generator to design your code in minutes. The platform offers a free version for basic needs and a 14-day free trial for premium features. You can create QR codes that link to payment pages, connect to apps like Venmo or PayPal, or direct users to your business’s payment portal.

Once your QR code is ready, customize it with your branding elements and download it in formats suitable for printing or digital use. Pageloot also provides templates optimized for posters, product labels, and other materials.

For example, a small café owner used Pageloot during the pandemic to replace paper menus, resulting in high customer satisfaction. With a 4.6/5 star rating based on user reviews, Pageloot offers a reliable solution for businesses looking to leverage QR codes for peer payments. The platform’s simple setup ensures you can start reaping the benefits of QR codes right away.

Future Trends and Potential Applications

The future of QR codes in peer payments is shaping up to be transformative, with emerging technologies poised to redefine how businesses and customers interact. Peer-to-peer transactions have already surpassed $1 trillion globally in 2023 and are projected to hit $8.4 trillion by 2027, growing at a 24% compound annual growth rate. These advancements will build on the current strengths of QR code payments, such as detailed analytics and adaptable customization, while introducing new layers of security and personalization.

Integration with Other Payment Systems

Technologies like AI and blockchain are reshaping QR code functionality, enhancing both security and user experience. AI, for instance, can tailor the content displayed after a QR code scan, creating a more personalized interaction. Meanwhile, blockchain adds an extra layer of trust by securely recording every scan event, offering an unchangeable log for better security and traceability.

In a notable example, a Chinese payment provider used AI-driven fraud detection to cut fraud rates by 60% within a year. This highlights AI’s ability to improve security without compromising the convenience of QR payments.

Blockchain also opens up innovative possibilities. For example, QR codes can be minted as NFTs, linking them to blockchain tokens for proof of ownership of digital assets. Together, AI and blockchain enable smarter fraud prevention, analyzing scan patterns while securely managing verified credentials. With many financial institutions exploring blockchain-based payment solutions, this trend shows no signs of slowing down.

Cross-platform compatibility is another exciting development. Future systems could allow a single QR code to function seamlessly across different payment platforms, thanks to AI and blockchain integration. However, achieving this level of functionality will require unified standards to ensure smooth adoption.

Standardization Efforts

One of the biggest challenges facing QR code adoption is the lack of interoperability across various systems. Fortunately, efforts to standardize QR code formats are gaining traction.

"The adoption of QR code-based instant payments in the United States has lagged behind other markets due to persistent technological and operational challenges", said Keith Riddle, SVP of Business Development at Payfinia and Chair of the FPC QR Code Interface Work Group.

Issues like outdated POS systems, compatibility problems, and network reliance have slowed progress. To address these barriers, industry groups are working on establishing cross-chain and cross-app compliance standards.

"Creating a seamless, user-friendly experience for both merchants and consumers is essential for the success of QR code-based instant payments", noted Caroline Serejo Cypriano, Co-Founder and COO at JJ4Tech.

Global market growth is also fueling these standardization efforts. Valued at $9.98 billion in 2022, the global QR code market is projected to grow at an annual rate of 16.9% through 2030. Standardized code formats and open APIs could enable developers to create innovative payment tools that work effortlessly across different regions and platforms.

Personalized Payment Experiences

The next phase of QR code payments is all about personalization. For example, a U.S. coffee chain used AI-enhanced QR code data to optimize its menu offerings, resulting in a 5% increase in average transaction value. By leveraging payment data, businesses can create tailored experiences that resonate with individual customers.

Loyalty programs are also evolving. Many UK restaurants that adopted QR code systems in 2023 reported faster table turnover and fewer billing errors. Future systems could track loyalty points automatically and deliver personalized promotions based on customer behavior.

Beyond payments, interactive experiences are expanding. QR codes are being used for augmented reality (AR) marketing, live polls, and even IoT applications where embedded codes report sensor data to the cloud. These innovations open up possibilities for context-aware payments and richer customer interactions.

For businesses using tools like Pageloot’s dynamic QR code generator, these personalization features are even more impactful. Dynamic QR codes can be updated in real time to reflect customer preferences, seasonal promotions, or location-specific offers without reprinting materials.

AI-powered recommendations are set to revolutionize customer interactions further. Imagine a system that analyzes your order history to suggest menu items or payment options tailored to your preferences. This type of functionality could make transactions not just faster but also more engaging and efficient.

With a 57% increase in QR code scans across the 50 countries with the highest usage rates, this technology is clearly gaining traction. Businesses that embrace these trends will be well-positioned to deliver the seamless and personalized payment experiences that customers are coming to expect.

Conclusion

QR codes have reshaped peer-to-peer payments in a big way. In 2023, nearly 7 out of 10 U.S. online adults used digital payments, and one U.S. bank reported an impressive 28 million Zelle transactions in just three months. These numbers highlight the growing reliance on QR-based payment systems and their broader impact.

Case studies underline this growth. For example, Starbucks saw its app usage jump from 12% to 25% of transactions, and another bank reported improved customer engagement thanks to QR code integration. Beyond convenience, QR codes also help businesses reduce fees, direct customers to secure payment pages, and gather valuable data insights. As Jennifer Sherman from NMI explains:

"Consumers don’t have to download an app or sign anything to use them. They simply use their camera app on their smartphones to scan the QR code, which then takes them to the website and gives consumers access to pay straight from their phones".

For businesses looking to adapt, tools like Pageloot’s customizable and dynamic QR codes with real-time analytics make it easier to meet evolving payment needs. Interested? Try this free QR generator to get started. These tools, combined with emerging trends, are set to push QR payments even further.

One such trend is the rise of QR code coupons, which promise deeper integration into contactless payments. Nick Starai from NMI highlights their potential:

"QR codes present businesses with an opportunity to adapt to consumers’ contactless preferences, no matter what line of business they are in. This will empower brick-and-mortar businesses to convert consumers from in-store to online to create a seamless customer experience and streamline the online payment process".

Whether you’re running a restaurant, managing an e-commerce site, or modernizing payment systems in any industry, QR codes offer a blend of convenience, actionable insights, and enhanced security. They are revolutionizing payment experiences across sectors.

The real question isn’t whether QR codes are part of the future of payments – they clearly are. The question is how fast your business can adapt to meet changing customer expectations and seize the opportunities QR codes bring.

FAQs

How do QR codes make peer-to-peer payments more secure?

QR codes enhance the security of peer-to-peer payments by encrypting transaction details, safeguarding sensitive information throughout the payment process. This encryption significantly reduces the chances of theft or tampering, as only authorized users can finalize the transaction.

On top of that, advanced tools like dynamic QR codes add another layer of protection. Unlike static QR codes, dynamic ones can be updated in real time, making it harder for fraudsters to replace or manipulate them. These features work together to make payments not only secure but also hassle-free, giving users confidence with every transaction.

What are the advantages of using dynamic QR codes for businesses, and how are they different from static QR codes?

Dynamic QR codes bring a level of versatility and functionality that static QR codes simply can’t match. While static QR codes are fixed and unchangeable after creation, dynamic QR codes let you update their content anytime – even after they’ve been printed. This means you can refresh links, update promotions, or modify information without needing to reprint materials, saving both time and money.

On top of that, dynamic QR codes offer valuable analytics, such as where and when scans occur and what devices are used. These insights help businesses better understand their audience and refine their campaigns. They also support features like retargeting, which can increase customer engagement and improve conversion rates. With these advantages, dynamic QR codes have become a powerful tool in today’s marketing and business strategies.

How can small businesses set up QR code payment systems affordably?

Small businesses can implement QR code payment systems without spending a fortune by using free or budget-friendly tools. Platforms like PayPal and Square let businesses generate QR codes for payments without any upfront charges. Instead, they apply small transaction fees – PayPal, for instance, charges 1.9% + $0.10 per transaction. This approach eliminates the need for costly hardware, making it a practical choice for smaller operations.

For businesses seeking a simple setup, free QR code generators can create static payment codes. These are great for straightforward transactions and require minimal effort to use. On the other hand, dynamic QR codes offer more flexibility, allowing updates or customization for businesses that need advanced features. By using these cost-effective solutions, small businesses can provide contactless payment options while keeping expenses in check and processes hassle-free.