QR codes and mobile wallets have revolutionized digital payments, offering a fast, secure, and user-friendly way to complete transactions. By 2025, global spending via QR code payments is projected to exceed $3 trillion, with nearly 29% of smartphone users relying on this technology. Here’s what you need to know:

- How They Work: QR codes store payment details that mobile wallets like Apple Pay and Google Pay can process instantly. Merchants display codes for customers to scan, or customers generate codes for merchants to scan.

- Types of QR Codes: Static codes are fixed and unchangeable, while dynamic codes can be updated, track analytics, and support advanced features.

- Benefits: They simplify transactions, reduce errors, and provide security through encryption and real-time monitoring.

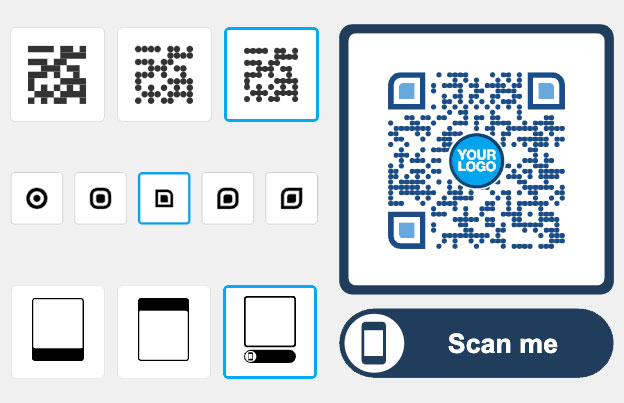

- Customization: Businesses can design QR codes with logos and colors to align with their brand.

- Applications: Retail, restaurants, e-commerce, ticketing, donations, and more are leveraging QR codes for seamless payments and customer engagement.

Dynamic QR codes stand out for their flexibility and tracking capabilities, making them ideal for businesses aiming to optimize their payment systems. Tools like Pageloot simplify QR code creation and management, offering analytics and customization for as low as $2.25/month.

Takeaway: QR codes are reshaping payments across industries, and integrating them into your operations can boost efficiency and customer satisfaction.

How to collect payments using QR in the US? – Accept cards, Apple Pay, Google Pay, ACH, installments

How QR Codes Work in Mobile Wallet Payments

Let’s dive deeper into how QR codes power mobile wallet payments. Understanding their mechanics reveals how they enable quick, secure transactions while boosting customer confidence.

Payment Workflows Explained

There are three main workflows for QR code payments, each tailored to different business needs. The most widely used is merchant-initiated payments, where businesses display a static QR code at checkout counters or on items like tickets. Customers scan this code with their mobile payment app, which automatically fills in the payment details.

For added security, dynamic QR codes are a step up. These unique, transaction-specific codes are generated for each purchase. Using a dynamic QR code generator, businesses can track scans, collect analytics, and update payment details without needing to create new codes every time.

The third option flips the process: customer-initiated payments. Here, users generate QR codes from their mobile wallets, which merchants then scan. This method works well for peer-to-peer payments or when customers want to control the payment process.

Regardless of the workflow, the process typically unfolds in five steps:

- A QR code is generated and linked to a payment.

- Customers scan it using their smartphone camera.

- Payment details automatically populate for review.

- The transaction is processed through the merchant’s payment gateway.

- A digital receipt confirms the payment.

This seamless flow eliminates manual data entry and speeds up transactions. A great example is Walmart’s use of QR codes in its Walmart Pay system. Shoppers scan a code at self-checkout, completing their purchases entirely through their mobile devices.

Adding QR Codes to Mobile Wallets

Integrating QR codes into mobile wallets requires meeting platform-specific guidelines. For Apple Wallet, businesses can use the "Add to Wallet" feature, enabling customers to save QR codes directly in their iPhone’s wallet app. This is especially handy for loyalty cards, event tickets, or recurring payments.

Similarly, Google Wallet offers a "Save to Google Pay" feature, providing a comparable experience for Android users. Both platforms require HTTPS to ensure secure data transmission. Once QR codes are saved in mobile wallets, users can access payment options instantly – no need to juggle multiple apps or navigate extra screens.

The integration process often involves working with a payment service provider that supports QR code payments. For example, in restaurants and cafes, QR codes allow diners to scan for digital menus, place orders, and pay directly at the table – all without waiting for a server.

With these systems in place, let’s explore how they’re being used in real-world scenarios.

Common User Scenarios

QR code payments are transforming various industries, from retail to hospitality and beyond. Here’s how:

- Retail: Static QR codes at checkout counters enable fast, cashless transactions, reducing wait times.

- Restaurants and Cafes: QR codes printed on bills or placed on tables let customers view menus, order, and pay directly from their phones. This reduces staff involvement and speeds up service.

- E-Commerce: Businesses include QR codes on checkout pages or email invoices, letting customers pay with a quick scan instead of manually entering details. It’s a game-changer for mobile shoppers.

- Subscriptions: Recurring payments become hassle-free. For instance, gyms might add QR codes to monthly invoices, allowing members to scan and pay in seconds.

- Amazon Go: This cashierless store concept uses QR codes for entry and payment. Shoppers scan a code from the Amazon Go app to enter, and their purchases are automatically charged when they leave.

- Donations: Nonprofits use QR codes on websites, social media, and physical locations, making it easier for donors to contribute using their preferred payment methods.

These examples show why QR code usage is on the rise. By 2025, over 100 million users in the U.S. are expected to rely on mobile QR code scanners, with global spending through QR code payments projected to surpass $3 trillion. The convenience and versatility of QR codes are reshaping how we pay.

QR Code Customization and Dynamic Features

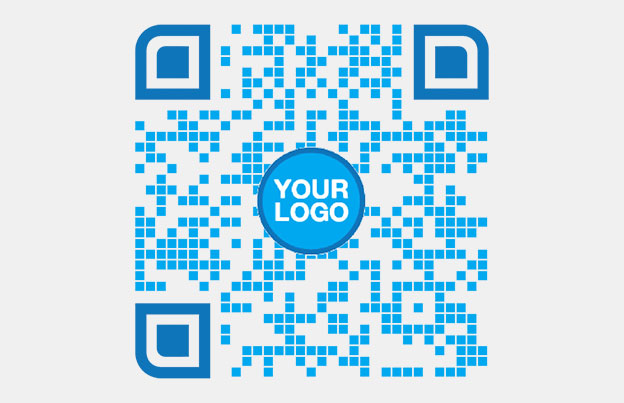

As mobile wallet integration becomes more advanced, QR code customization is stepping up to enhance both security and brand engagement. Gone are the days of plain black-and-white QR codes; now, customized versions not only look better but also help reinforce brand identity and encourage mobile wallet interactions. By incorporating your brand’s colors, logo, and unique styling, you can build trust and make a lasting impression with every scan.

Why Customize QR Codes

Customizing QR codes isn’t just about aesthetics – it’s about making a stronger connection with your audience. Studies show that using brand colors can improve recognition by up to 80%. To create an effective customized QR code, focus on three key elements: color, logo, and frame.

- Color: Use a two-color scheme that matches your brand’s palette. Always ensure the foreground color is darker than the background for easy scanning. For instance, a blue-on-white design could align perfectly with your branding.

- Logo: Placing your logo in the center of the QR code makes it instantly recognizable. This approach works especially well on business cards or flyers where a strong brand presence is critical.

- Frame and CTA: Adding a frame around your QR code can make it pop while still maintaining the required quiet zone for scanning. Including a clear call-to-action (CTA) like "Scan to Pay" or "Tap for Menu" can encourage users to interact with it.

When customizing, balance is crucial. Maintain enough contrast between the foreground and background to ensure readability. Also, test your QR codes across different devices and lighting conditions. For printed materials, use high-resolution formats like SVG, EPS, JPG, or PNG, and ensure the size is at least 1 x 1 inch (2.5 x 2.5 cm) for optimal scanning.

Dynamic QR Code Advantages

Dynamic QR codes bring a level of flexibility and functionality that static codes simply can’t match. Instead of storing fixed information, dynamic QR codes use a short URL that redirects to content you can update anytime. This means you can change the destination without having to reprint the code – a huge convenience.

Another major benefit is real-time analytics. With dynamic QR codes, you can track scan data, including locations, device types, time of scans, and even conversion rates. These insights can help fine-tune your mobile wallet strategies for better results.

Dynamic codes also open up opportunities for personalized campaigns. For example, a restaurant might display lunch specials during midday scans and dinner options in the evening. In 2024, 40% of global QR code scans were tied to marketing campaigns, highlighting how these features can drive customer engagement.

Popular QR Code Applications

QR codes are finding their way into an impressive range of applications, often tied to mobile wallet functionality:

- Contactless Payments: Many retailers now use QR codes at checkout, allowing customers to pay through apps like Apple Pay or Google Pay, eliminating the need for physical card readers.

- Digital Ticketing: Concert venues, movie theaters, and public transit systems rely on QR codes for ticket purchases and storage, making the process entirely digital.

- Loyalty Programs: Scanning a QR code can instantly add loyalty cards to a mobile wallet, making it easier for customers to collect and redeem points.

- Personalized Campaigns: Big brands like Coca-Cola and Pepsi have used QR codes on product packaging to engage customers with interactive content and promotions.

- Real Estate: QR codes on property signs can link to virtual tours or payment options for application fees.

- Healthcare: Hospitals and clinics use QR codes for scheduling appointments or processing co-payments.

- Education: Schools and universities integrate QR codes for tuition payments and campus services.

Whether it’s payments, customer engagement, or interactive experiences, customized and dynamic QR codes are proving their value across industries. By combining visual design with dynamic functionality, businesses can create QR codes that not only look great but also deliver practical, user-friendly solutions.

Analytics, Automation, and Security Features

QR codes play a critical role in driving mobile wallet transactions by combining advanced analytics, automation, and robust security measures. Building on the customization benefits of QR codes, these features ensure continued effectiveness and reliability in mobile wallet payments. With dynamic QR codes leading the way, analytics and automation provide measurable results, while security safeguards every transaction.

Benefits of QR Code Analytics

Analytics offer a detailed view of how QR codes are used, including scan locations, device types, timestamps, and conversion rates. These insights help businesses refine their marketing strategies and improve customer experiences.

For example, location data is particularly valuable for businesses operating in multiple areas or conducting market tests. A fitness studio, for instance, used a video QR code on a billboard to test various locations. This helped them identify which area delivered the best results and allowed them to allocate their advertising budget more effectively.

With 54% of consumers reporting that they’ve scanned a marketing-related QR code, businesses have a chance to segment their audience and tailor content to align with each stage of the customer journey.

Connecting QR Codes to Marketing Automation

QR codes act as a seamless link between offline interactions and digital marketing automation systems. By integrating QR codes with tools like CRM platforms or automation software (e.g., Zapier, HubSpot), businesses can streamline lead generation and follow-ups.

Take L’Oréal USA’s 2023 campaign as an example. They placed QR codes in taxis to engage passengers during traffic delays. These codes directed users to instructional videos and landing pages, which resulted in an 80% increase in app downloads.

Offering incentives such as e-books, webinars, or discounts further enhances lead generation. This approach enables businesses to segment leads effectively and deliver personalized content through mobile wallet notifications or email campaigns.

"Statistics show that buyers don’t do that. They want to learn at their own pace and be reached when they need more information or are ready to buy. A well-constructed marketing automation strategy makes that a reality." – John McTigue

QR codes also support email marketing efforts by promoting app downloads, distributing mobile coupons, or encouraging mobile wallet adoption. To ensure a smooth experience, businesses must optimize landing pages for mobile devices, ensuring users can transition seamlessly from scanning to conversion.

Strengthening Security for Mobile Wallet Transactions

While analytics and automation enhance customer engagement, security is the backbone of mobile wallet transactions. With over 90% of data breaches exploiting unencrypted connections, implementing strong security measures is essential for protecting customer data and maintaining compliance.

Encryption and Authentication: These are critical for secure QR code payments. Using AES encryption and dynamic QR codes can reduce fraud risk by up to 99.9%. Dynamic QR codes, which change after a single use or on a timed basis, prevent duplicate transactions and unauthorized captures.

Real-Time Monitoring: Monitoring transaction behavior is another key fraud prevention strategy. Companies that implement behavioral analytics have reported up to a 70% reduction in fraud cases. This allows businesses to quickly detect and address suspicious activity.

User Education: Since 60% of users are unaware of the risks associated with scanning unknown QR codes, educating customers is vital. With 70% of security breaches resulting from human error, businesses should teach users how to identify secure QR codes and avoid phishing scams.

For instance, a restaurant chain ensured its menu QR codes directed customers to secure websites, protecting against phishing and malware. Similarly, hotels conduct regular audits of their QR codes – used for room service menus and local guides – to confirm they link to HTTPS-enabled websites.

Implementation Best Practices: Regular updates to applications can address 90% of software vulnerabilities. Businesses should also establish clear protocols for reporting suspicious QR codes and offer alternative access options for customers who prefer not to scan them.

When creating a QR code for mobile wallet integration, prioritize security features such as encrypted connections, secure display locations, and verification systems that allow users to confirm QR code destinations before completing transactions.

sbb-itb-74874c9

Pageloot solutions for businesses and marketers

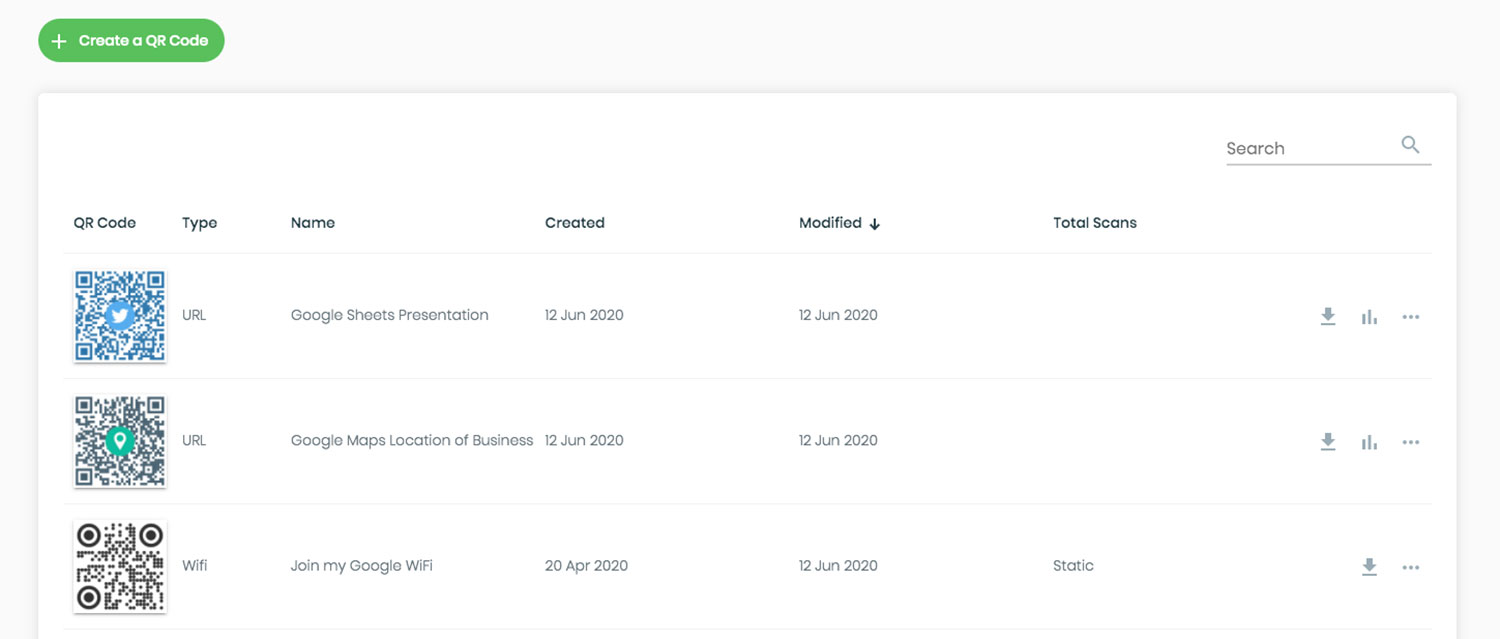

Pageloot provides an all-in-one platform designed to simplify and enhance mobile wallet campaigns. By combining advanced analytics, customizable QR codes, and automation, Pageloot makes managing QR code campaigns easier and more efficient.

Pageloot platform benefits

Pageloot has earned the trust of over 20,000 companies in 110 countries since its launch in 2019. Its user-friendly platform is packed with features tailored to meet the needs of businesses integrating mobile wallets.

With real-time analytics, businesses can track QR code scans, locations, and engagement metrics to fine-tune their campaigns. Editable QR codes allow updates to payment details or promotions without needing to reprint materials. Dynamic QR codes ensure links remain current with real-time updates. Additionally, Pageloot supports custom designs to align with brand identity, making it a powerful tool for secure and adaptable mobile wallet transactions.

"Creating QR codes is just the start. Track, analyze, and optimize every scan – all from one powerful platform." – Pageloot

Pageloot also offers over 25 QR code formats to cater to various use cases. Whether it’s PDF QR codes for receipts, vCard QR codes for contact details, or video QR codes for tutorials, the platform has businesses covered. Plus, professionally designed templates save time while ensuring a polished, on-brand look for campaigns.

Industry use cases

Pageloot’s tools have been successfully applied across industries, demonstrating measurable results and adapting to evolving QR payment trends.

- Hospitality and food service: Brunswick Cafe saw a surge in new customers and profits in June 2024 by implementing dynamic QR menus. These menus not only streamlined updates but also provided insights into customer demographics, enabling targeted marketing.

- Religious organizations: In June 2024, New Testament Church of God in Birmingham simplified its donation process with Pageloot QR codes, resulting in a 30% increase in giving.

- Retail and e-commerce: Winemaker Malenka transformed their customer experience by using QR codes on wine bottles. Customers could scan the codes to access product details, tasting notes, and purchase options, leading to increased sales and engagement.

- Healthcare: Providers can use Pageloot for patient forms, app downloads, and appointment scheduling.

- Education: Schools and universities leverage QR codes to connect students with resources and streamline campus payments.

Getting started with Pageloot

Pageloot’s tools make it easy for businesses to move from planning to execution. The platform offers options that cater to every need, from free basic features to premium capabilities.

Free QR code creation provides a simple way for businesses to test mobile wallet integration. Static QR codes can be created at no cost, offering an entry point for experimentation. For those ready to scale, premium plans unlock advanced features like scan tracking, editable QR codes, and detailed analytics. Pricing starts at €2.25 per month, with a 14-day free trial available.

The platform’s intuitive interface means no technical expertise is required to create QR codes. Pageloot also integrates with popular tools, streamlining campaign management.

Account Manager Preston F. highlights the platform’s strengths:

"Pageloot stands out among similar services."

For businesses ready to explore mobile wallet integration, Pageloot’s QR code solutions provide a clear path to success. Whether starting small or planning a large-scale campaign, Pageloot offers the tools to grow and adapt as business needs evolve.

Static vs Dynamic QR Codes for Mobile Wallets

Let’s dive deeper into the differences between static and dynamic QR codes, particularly in the context of mobile wallets. The choice between these two types of codes can significantly impact everything from user experience to tracking capabilities, making it a crucial decision for businesses aiming to optimize their payment systems.

Static QR Codes: Simple but Limited

Static QR codes are fixed, meaning the information embedded in them cannot be changed once they’re created. If there’s a need to update payment details or correct an error, you’ll have to generate new codes and reprint them. While they’re straightforward to set up and cost-effective, their lack of flexibility can be a drawback for businesses that require frequent updates or customizations.

For instance, static QR codes often require manual payment entry, which can slow down the checkout process. As payment expert Celine Wee points out, "Static QR codes are easier to set up", but they lack the advanced features that many businesses now find essential.

Dynamic QR Codes: Flexible and Feature-Rich

Dynamic QR codes, on the other hand, function more like a webpage – they can be updated without altering the code itself. This flexibility makes them ideal for businesses that need to adapt quickly. For example, dynamic QR codes can display pre-filled payment amounts, significantly improving the checkout experience. As Wee also notes, "Dynamic codes might be harder to set up, but are a better user experience".

Dynamic codes shine in mobile wallet integrations due to their ability to generate short, clean URLs, which scan faster and more reliably than the longer URLs found in static codes. Additionally, they offer detailed tracking and analytics, allowing businesses to monitor campaign performance and customer behavior in real time.

Security and Scalability

Security is another area where dynamic QR codes take the lead. Businesses can update payment destinations regularly, reducing the risk of fraud. They can also implement password protection and real-time monitoring for high-value transactions, ensuring a safer payment process.

Key Differences at a Glance

Here’s how static and dynamic QR codes stack up when used in mobile wallet applications:

| Feature | Static QR Code | Dynamic QR Code |

|---|---|---|

| Content Editability | Not editable once created | Editable even after deployment |

| Payment Amount Handling | Manual entry required | Pre-filled amounts possible |

| Tracking and Analytics | No tracking available | Comprehensive scan analytics |

| URL Structure | Long, complicated URLs | Short, clean URLs |

| Scan Speed | Slower scanning | Faster scanning |

| Cost | Usually free | Subscription typically required |

| Campaign Scheduling | Not possible | Supports time-based campaigns |

| Retargeting Capabilities | Not available | Online retargeting enabled |

| Security Updates | Requires reprinting | Real-time updates |

| Best For | One-time events, personal use | Professional campaigns, ongoing business |

When to Use Each Type

Static QR codes are best suited for scenarios where the information is unlikely to change – think permanent donation links or basic contact details. They’re a simple and budget-friendly option for businesses with minimal needs.

Dynamic QR codes, however, are better suited for professional campaigns and businesses requiring advanced features like tracking, retargeting, and personalized experiences. With global QR code payments expected to surpass 5.5 billion users by 2025 and spending projected to exceed $3 trillion USD, the added capabilities of dynamic QR codes are becoming increasingly valuable.

Final Considerations

When planning your mobile wallet strategy, think about how often you’ll need to update payment details, whether analytics are essential for optimizing campaigns, and if creating tailored customer experiences is a priority. For most businesses, these factors make dynamic QR codes the smarter investment, offering the flexibility and insights needed to thrive in a rapidly evolving payment landscape.

For businesses aiming to stay competitive, dynamic QR codes provide the tools to meet growing customer expectations while supporting long-term growth.

Conclusion and Next Steps

Key Benefits Recap

QR codes have reshaped mobile wallet payments, turning them from a simple convenience into an essential tool for businesses. With more than 11 million households in the U.S. actively scanning QR codes, their advantages go well beyond just processing payments.

One standout benefit is the enhanced customer experience. Dynamic QR codes simplify the payment process by removing the need for manual entry, minimizing checkout delays, and offering pre-filled payment amounts. This smoother experience directly impacts sales – businesses using dynamic QR codes have reported sales increases of 20–30%.

Another major advantage lies in data-driven insights. QR codes provide detailed analytics on customer behavior, including scan locations and peak usage times. This valuable data helps businesses fine-tune their payment systems and design more effective marketing campaigns.

Restaurant owner Hugo Laurent highlights this perfectly:

"The easiest and most reliable QR code generator ever – PDF files upload instantly, and our restaurant menus are now digital."

Dynamic QR codes also offer unmatched flexibility. Businesses can update payment details, promotions, or product information without needing to reprint materials. This is especially useful for industries like restaurants and e-commerce, where agility is key.

These benefits make it clear: integrating QR codes into your business operations is a step worth taking.

Getting Started

Ready to take advantage of QR codes? It’s easier than you might think. Pageloot provides a user-friendly platform packed with advanced features to help you get started without any technical headaches.

You can try it risk-free with a 14-day trial, gaining access to tools like scan tracking, editable QR codes, and in-depth analytics. With plans starting at just $2.25 per month, the cost is quickly offset by improved efficiency and higher sales.

To begin, choose the right type of QR code for your needs. While static QR codes are suitable for basic uses, dynamic QR codes offer the flexibility and tracking capabilities that modern businesses demand. With Pageloot’s QR code generator, you can create customized codes that align with your brand by adding logos, colors, and call-to-action designs.

Pageloot’s ease of use is backed by its 4.6/5 overall rating and a 4.5/5 score for user-friendliness. This means you don’t need to be a tech expert to implement QR code solutions effectively.

Expand your QR code usage across different areas of your business. Whether it’s business cards, product labels, or marketing materials, Pageloot supports a wide variety of applications. Industries like healthcare, education, and real estate are already leveraging these solutions to great effect.

The shift to mobile wallets is happening now, and businesses that act quickly will gain an edge over competitors. The real question is not whether to adopt QR codes – but how soon you can start.

Take the first step today: create your QR code and join thousands of businesses transforming their payment systems.

FAQs

How do dynamic QR codes improve security and provide better analytics for mobile wallet payments?

Dynamic QR codes bring an added layer of security to mobile wallet payments by enabling real-time updates and encryption. This reduces the chances of fraud and prevents unauthorized access. Unlike static QR codes, dynamic ones can be updated without needing to reprint, keeping sensitive information safer.

On top of that, dynamic QR codes offer valuable analytics, including insights into user interactions, payment patterns, and transaction details. These features allow businesses to track performance and refine their payment systems, making dynamic QR codes a smarter and more secure choice for mobile wallet transactions.

How can businesses integrate QR codes into mobile wallet systems effectively?

To integrate QR codes into mobile wallet systems effectively, businesses can take these practical steps:

- Create QR codes that link directly to payment information or digital passes, ensuring compatibility with widely used wallet apps like Google Wallet and Apple Wallet.

- Position QR codes thoughtfully in places like checkout counters, on receipts, or in digital communications, making them easy for customers to scan.

- Opt for dynamic QR codes to enable real-time updates, improved tracking, and stronger security. These codes let businesses update the linked content without the hassle of reprinting or redistributing them.

By using customizable QR codes and analyzing their performance, businesses can offer their customers a seamless and secure experience.

How can businesses design QR codes that reflect their brand and boost customer engagement?

Businesses can create QR codes that align with their brand by incorporating logos, brand colors, and distinctive patterns. These elements not only make the codes more eye-catching but also help reinforce the brand’s identity, making them instantly recognizable.

With dynamic QR codes, companies can share personalized content like targeted promotions or location-specific details, making the interaction more engaging and relevant. Including a clear call-to-action – such as "Scan to discover" or "Claim your offer" – can further encourage users to take action. Branded and creatively designed QR codes do more than just stand out; they help build a deeper connection with your audience.